Cloud Edge Tracker Q4: Use Cases and 5G Acceleration

As the year draws to a close, our Cloud Tracker Pro subscription service has taken another look at the key trends in 5G and capital spending among telcos and hyperscalers, which we track regularly. With the publication of our fourth quarter 2022 5G Edge Cloud Tracker, we have a few highlights we can share as a preview for non-subscribers

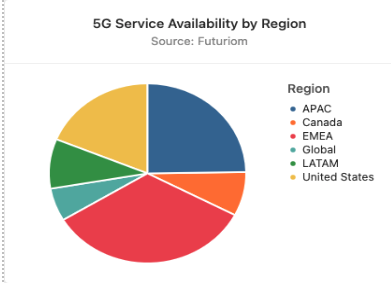

5G rollouts continue at a steady pace. The final part of 2022 saw the ongoing spread of consumer 5G services worldwide. According to our data on 101 services from 82 providers, Europe is especially active, with China and the Asia-Pacific region continuing to broaden coverage. India saw its first 5G rollouts in October, and that country is set for a rapid proliferation of services. In Latin America, America Movil continues to spread 5G services via its Claro subsidiaries and other providers. The Middle East and Africa are on track for more 5G rollouts next year.

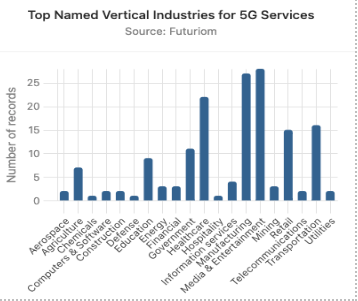

Consumer services have failed to impress; business applications are the goal. Though most telco services are aimed at consumer applications such as gaming and video streaming, consumer response has been lukewarm. Providers are betting on the future of business applications, particularly in areas such as manufacturing, healthcare, retail, and transportation:

Private wireless is the focus of business 5G. Nearly all business use cases for 5G depend on private wireless, which is typically supplied via Citizens Broadband Radio Service (CBRS) in the U.S. This trend will likely continue, particularly in the areas of manufacturing, healthcare, retail, and logistics.

Private wireless trials exceed 5G rollouts. While 5G rollouts continue to pop up steadily in various locales, tests and trials of 5G services, particularly in private wireless networks for business, have outnumbered the actual services offered. Futuriom has documented over a dozen trials introduced worldwide over the past few months, mostly by telcos and their vendors. Examples include a range of seaports, factories, and hospitals.

Hyperscalers are expanding their 5G profiles. Our data shows that 91% of 5G services come from telcos, 6% from cloud hyperscalers, and 3% from managed service providers. But hyperscalers are intent on growing their share. AWS, Microsoft, and Google Cloud are focused on extending their distributed edge services into telco networks and/or providing cloud-based 5G core services for telco deployment. Examples include Bell Canada Public MEC with AWS Wavelength, Verizon 5G Edge with AWS Wavelength, and Microsoft Azure’s Private MEC technology, which includes an Azure Private 5G Core and works with Azure Stack Edge and Azure Arc to bring Azure resources to the network edge in a telco network.

Hyperscalers are spending more on their networks than telcos. Our research shows that hyperscalers such as Alphabet, Amazon, Meta, Microsoft, and IBM are outspending their telco counterparts when it comes to capex. This is a trend we noted last quarter, which appears to be tracking upward.

Looking Ahead

So what can we expect to see in the coming year? Based on our research and data, it seems clear that telcos are counting on business applications to increase 5G momentum, and they’re eyeing private wireless networks as key to that strategy. Meanwhile, cloud hyperscalers remain intent on moving into 5G business services, with and without the telcos (Amazon’s AWS Private 5G being one example).

Regarding capital spending, it’s evident that companies plan additional spending despite macroeconomic headwinds. And hyperscalers will continue to outspend the telcos on capex, both to grow their networks as well as to increase their influence in the telco services arena.

(To take a look at what's include in the Cloud Tracker Pro Service and to subscribe, go here.)