2020 SD-WAN Growth Report: Market Poised to Accelerate

It's here! Futuriom's fourth annual SD-WAN Infrastructure Growth report gives you the lowdown on what's driving growth in the software-defined wide-area networking (SD-WAN) market.

Our research, based on a survey of 100 end users as well as dozens of interviews with professionals in the IT and networking markets, projects continued growth in SD-WAN through at least the next 3-5 years. Enterprises and service providers alike are interested in deploying SD-WAN technology in services to deliver cloud-based orchestration and automation of networking and security.

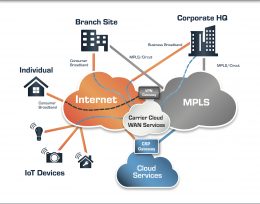

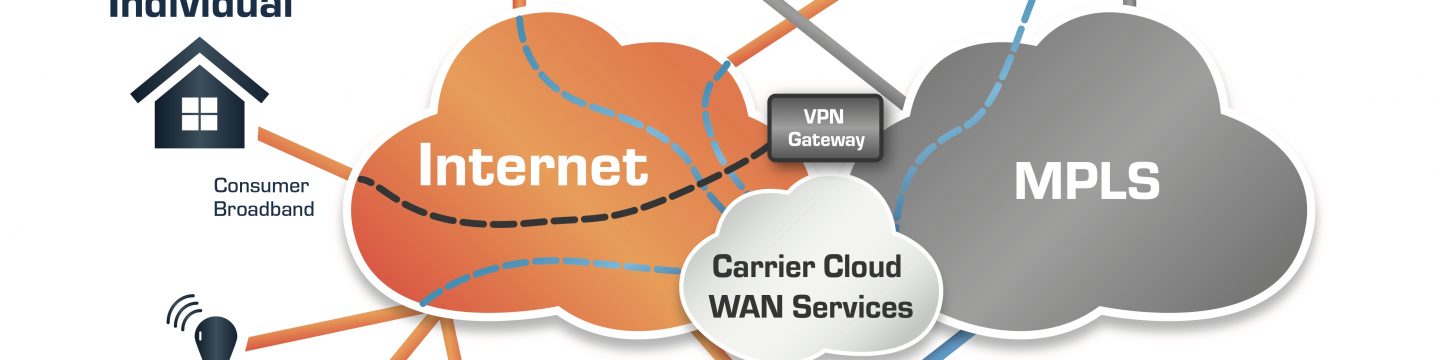

Cloud-delivered SD-WAN, a growing technology domain that enables enterprises and organizations to set up and manage secure WAN connections using cloud software deployment and management approaches, is gaining and increasing role to speed up and secure cloud connectivity. Enterprises are buying SD-WAN to reduce the complexity in configuring branch-office devices, routing schemes, and network addresses. With SD-WAN, many of these functions can be abstracted into the cloud and managed by the service provider or an enterprise manager using a cloud interface, rather than using proprietary networking equipment.

The report was sponsored by Aryaka Networks, Citrix Systems, Fortinet, Nuage Networks, Silver Peak, Versa Networks, and VMware (VeloCloud).

The full report is available to our Cloud Tracker Pro subscribers, but a summary of the findings for mere mortals can be seen below.

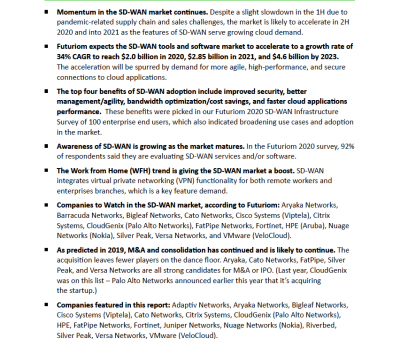

- Momentum in the SD-WAN market continues. Despite a slight slowdown in the 1H due to pandemic-related supply chain and sales challenges, the market is likely to accelerate in 2H 2020 and into 2021 as the features of SD-WAN serve growing cloud demand.

- Futuriom expects the SD-WAN tools and software market to accelerate to a growth rate of 34% CAGR to reach $2.0 billion in 2020, $2.85 billion in 2021, and $4.6 billion by 2023. The acceleration will be spurred by demand for more agile, high-performance, and secure connections to cloud applications.

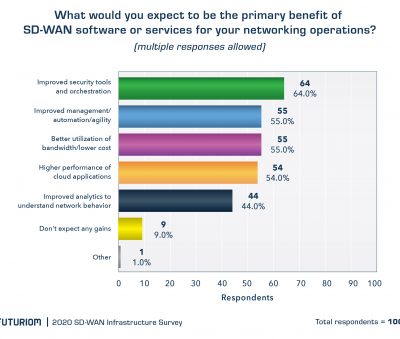

- The top four benefits of SD-WAN adoption include improved security, better management/agility, bandwidth optimization/cost savings, and faster cloud applications performance. These benefits were picked in our Futuriom 2020 SD-WAN Infrastructure Survey of 100 enterprise end users, which also indicated broadening use cases and adoption in the market.

- Awareness of SD-WAN is growing as the market matures. In the Futuriom 2020 survey, 92% of respondents said they are evaluating SD-WAN services and/or software.

- The Work from Home (WFH) trend is giving the SD-WAN market a boost. SD-WAN integrates virtual private networking (VPN) functionality for both remote workers and enterprises branches, which is a key feature demand.

- As predicted in 2019, M&A and consolidation has continued and is likely to continue. The acquisition leaves fewer players on the dance floor. Aryaka, Cato Networks, FatPipe, Silver Peak, and Versa Networks are all strong candidates for M&A or IPO. (Last year, CloudGenix was on this list – Palo Alto Networks announced earlier this year that it’s acquiring the startup.)

- Companies featured in this report: Adaptiv Networks, Aryaka Networks, Bigleaf Networks, Cisco Systems (Viptela), Cato Networks, Citrix Systems, CloudGenix (Palo Alto Networks), HPE, FatPipe Networks, Fortinet, Juniper Networks, Nuage Networks (Nokia), Riverbed, Silver Peak, Versa Networks, VMware (VeloCloud).